What is an IoT system integrator?

System Integrator refers to an enterprise that has system qualifications and can implement system integration for industry users. System integration includes equipment system integration and application system integration. Therefore, system integrators are also divided into equipment system integrators (or hardware system integrators, weak current integrators) and application system integrators (that is, industry information solution solutions often referred to as ).

The Internet of Things integrator refers to an enterprise that integrates the technologies, products and services of other companies in the field of Internet of Things to form a complete set of Internet of Things solutions.

What are the types of IoT system integrators?

The IoT integration market is dominated by large global IT and operational technology (OT) integrators, such as Tata Consulting (TCS), Wipro, Accenture, etc. In recent years, large cloud computing companies, such as Microsoft or AWS, have established IoT integration businesses and affiliated partner networks, and have conducted thousands of on-site implementations with customers.

Other large software or hardware companies also have dedicated IoT integration teams (such as IBM, Bosch and Siemens Advanta). Finally, traditional consulting companies and consulting businesses such as PricewaterhouseCoopers, McKinsey, Boston Consulting Group and Ernst & Young provide professional Internet of Things services.

Although companies have their own advantages, due to lack of internal knowledge, staff shortages, and the complexity of IoT settings, many companies are slowly turning IoT projects to integrators.

In a recent survey by IoT Analytics, 55% of companies implementing IoT projects use professional service companies or system integrators. This is a finding from a recent IoT analysis survey that asked IoT decision makers which vendor they used to implement IoT projects.

When asked why they hired IoT integrators, decision makers pointed out lack of internal experience (78%), staff shortage (72%), or technical complexity (71%). 92% of the interviewed senior information technology decision makers agreed that "company-wide digitization" will become more important after the new crown epidemic, and the role of IoT integrators is also crucial. The digital skills gap enhances this importance, which is the main reason why companies hire integrators.

Integrators play a vital role in the IoT ecosystem. Both vendors and users need to ensure that the right integration partner is selected to make their solution successful. This has also become a common phenomenon in today's Internet of Things industry.

For technology suppliers, IoT integrators can help IoT technology solution providers meet customer needs and maintenance, and suppliers can focus on the update and iteration of technology products;

For users, system integrators understand the needs of the industry better, and are more convenient for follow-up program maintenance, and are more for users.

All these have prompted integrators to become a backbone force in the Internet of Things industry.

What are the driving factors of the IoT system integration market?

The following trends are driving the demand for IoT professional services:

1. Move to the cloud. For many companies, pushing existing workloads to the cloud is more complicated than expected.

2. New connection and hardware settings. IoT integrators support the company during changes or updates of IoT connectivity technologies (for example, transition to 5G or low-power wide area network (LPWAN)), and continue to replace and integrate more powerful edge computing devices as part of the hardware transformation .

3. The expansion of the Internet of Things project. Some IoT projects are expanding to thousands (sometimes millions) of devices. This is complicated and usually requires outsourcing the business to a service provider.

4. Data streamlining and analysis. System integrators are often required to connect data streams and enable new software tools to take advantage of artificial intelligence (AI) and machine learning (ML).

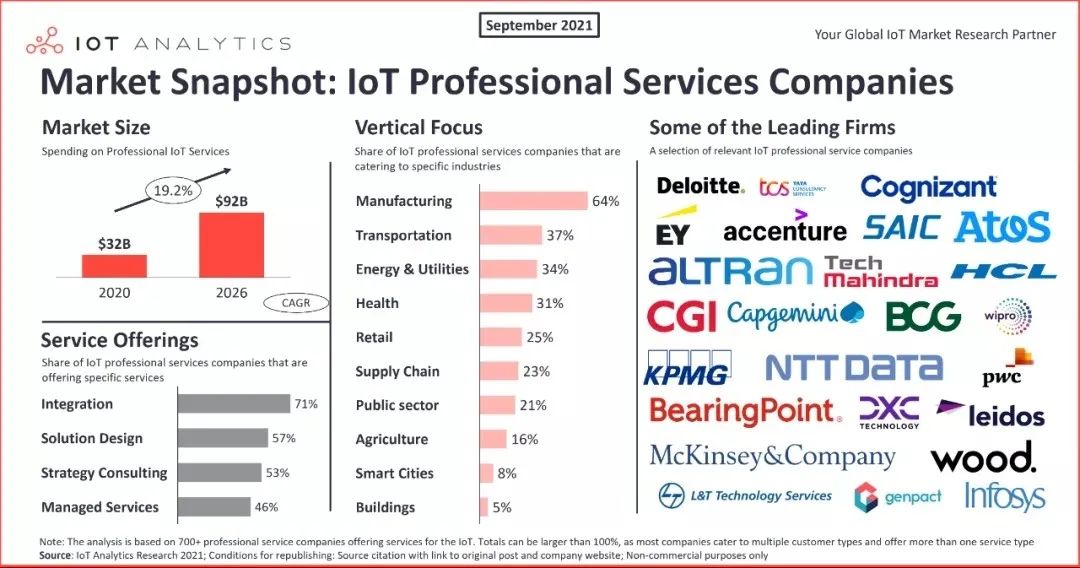

According to the research results of IoT Analytics, the expenditure of IoT integrators and professional services will increase in 2021. The Internet of Things professional services market is expected to grow from US$32 billion in 2020 to US$92 billion in 2026.

At this rate, the professional IoT service market (with a compound annual growth rate of 19.2% for 2020-2026) is expected to surpass the professional IT service market. It is estimated that by 2026, IoT services will account for 6% of the global IT and IoT service market.

What are the key points of IoT system integration service and technology provision?

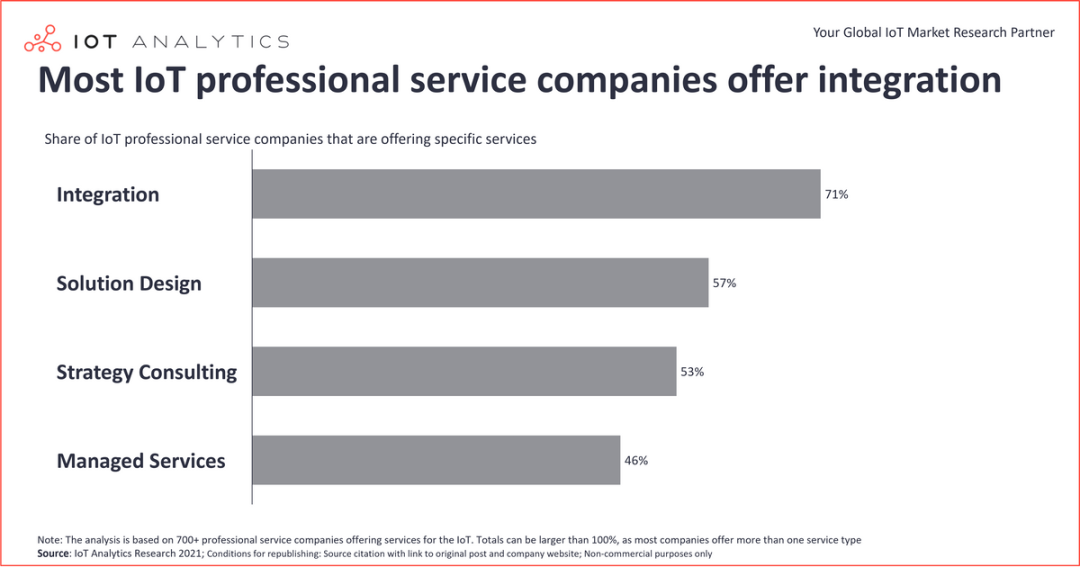

IoT Analystics has identified four different IoT system integration services: strategic consulting, solution design, integration, and operation/management services. Although many IoT integrators provide comprehensive integration services, some integrators provide limited integration services.

Almost all (93%) identified system integrators are involved in software integration. 51% are concerned about hardware, while 42% are concerned about various forms of IoT connections.

Integration is the main purpose of selecting an IoT system integrator. Through the integration with all sensors and data sets, after strategic consultation, appropriate management and control solutions can be formulated, and finally the deployment and implementation of the IoT can be achieved.

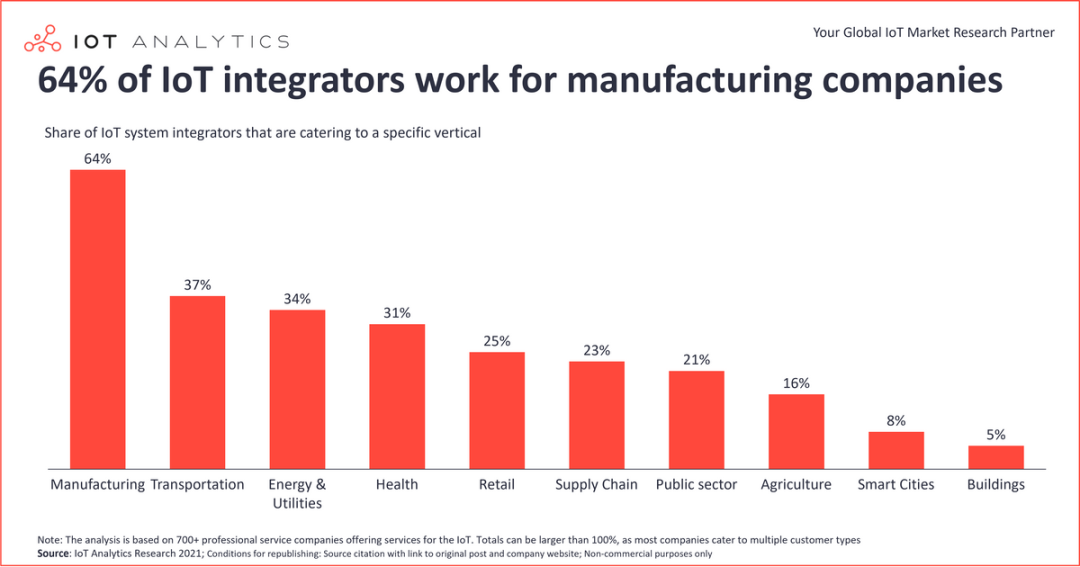

What are the vertical focuses of different industries?

Different industries have different needs. Manufacturing companies with global factory networks have specific IoT system integration requirements that are different from agricultural companies or healthcare companies.

Secondly, the transportation industry (such as connected cars and connected cars) is the second most common industry, accounting for 37%. Taking my country as an example, in the development of the Internet of Vehicles, Wuxi relies on the first-mover advantages of the national-level Internet of Vehicles construction pilot area and the "dual wisdom" pilot city, and cooperates with Huawei, iSoftScience and other companies to start the construction of the Mashan intelligent bus trial commercial Platform pilot projects, try first.

This is followed by energy and utilities (such as smart metering and smart grid), which accounted for 34%. Taking the smart grid as an example, the new generation of power grids uses the Internet of Things technology to improve the intelligent perception capabilities and real-time monitoring levels of all links in the power generation, transmission, distribution, consumption, and power markets.

in conclusion

The three dimensions highlighted in this article (company type, product, and vertical focus) demonstrate the complexity and breadth of the IoT integration landscape. Few IoT integrators can do all of this, but there are always people who focus on niche markets.